Finance Strategy for Business Owners

Talk to us about your business

Our award-winning expertise in commercial lending and banking transactions is founded on a depth of knowledge across accounting, economics, marketing, strategy and legal.

For a business owner, funding is often a means to an end. The end might be a short-term problem or a long-term aspiration – or perhaps both. We strive to understand and assist with your goals and can advise you during the journey towards your desired result.

Start here with a Business Review

Our Business Review process can raise awareness of financial or non-financial scenarios that need addressing in your business, including analysing your industry positioning. Let us assist you with your short and long-term objectives.

We Connect

We work with you initially to build an understanding of your goals and objectives balanced with an analysis of your business and industry.

- Assess your company background, funding objectives and business goals

- Analysis of your industry, products and services segmentation

- Collect financial trading history from Profit & Loss, Balance Sheet, Debtor & Creditor reports, and Cash Flow forecast

- Prepare a Strategic Finance Review for your consideration

We Transact

If funding is the correct solution for your goals, we approach the financier who best suits your needs. We also explore options to achieve your goals beyond funding.

- Our team prepares a Credit Proposal & Structure Recommendation for your consideration

- Upon your acceptance, we action the formal credit submission to your selected financier

- Action other needs on your behalf - such as financial planning, insurance, legal or accounting services

We Nourish

We stay connected on the journey for as long as you need, to support you in future transactions and seek opportunities to nourish our ongoing relationship.

- We manage valuations, loan progress, loan approval and settlement process on your behalf

- Ensure that you understand and implement any loan covenants

- Assist you in taking action on sales and marketing strategies

- Provide ongoing guidance to assist you in achieving operational and strategic goals for growth, succession, or sale of your business

Review your business

Case Studies

Financial Planning owner needed better financing for growth strategy

The customer has over 15 years' history in the Financial Planning industry, multiple partners and 35 staff across various locations.

Challenges

Several acquisitions later, the business consisted of some customer bases transitioning to their branding and a few stand-alone firms at different locations. By the customer's admission, their banking strategy for growth was very aggressive but based on sound fundamentals.

However, the result was a collection of separate short-term financing facilities, with a repayment structure mismatched to the cash flow generated over the term. Hence, the customer lacked the necessary working capital to invest further in the business locations.

Strategy

MCP conducted a Business Review to assess working capital needs over the next three years and obtained a macro understanding of the business. With support from the customer's accountant, we analysed three years of customer financial forecasts and tested assumptions.

Results

- Our review identified solid historical and forecast cash flow; however, the amortisation profile for debt repayment was excessive.

- In reviewing the banking structure, we noted that the collateral provided by the customer was relatively light.

- We were able to share scenarios where providing additional security for lending would drive a change in the lender's appetite that was tested on the customers' existing bank and an alternative lender.

Add Value

- MCP shed light on the opportunity cost of providing additional security, communicating this in simple terms.

- As a result, MCP negotiated an annual interest rate saving and extended the loan terms to reduce the minimum repayment commitment.

- With an ongoing relationship established, MCP can understand and support the financing of new acquisitions.

Transport owner receives significant interest rate savings

A generational family business in the transport industry with over 30 years' history. The business has an extensive road transport fleet, a diverse customer base and over 200 staff.

Challenges

Despite a complete trading history with the same bank, a lack of consistency in Relationship Bankers meant the bank did not keep abreast of changing needs as the business evolved.

The unfortunate result was several separate financing facilities, with interest rates and loan terms not correctly matched to the purpose of the borrowings or the useful life of the assets. Plus, the frustration of an exhaustive credit application process each time the customer wanted to purchase a new truck.

Strategy

The customer requested a Business Review that included an assessment of their banking interests. MCP walked through 15 key questions to ensure a macro understanding of the business, analysed two years of financial performance and requested a 12-month forecast.

Results

- Our review identified working capital challenges due to cash flow funding of assets with a long useful life.

- We highlighted a material difference between accounting and "cash" profit, showing a sound business with a few issues around credit control and inventory management.

- From a credit perspective, the collateral provided by the customer was excessive and the interest rates charged were not reflective of that position.

Add Value

- MCP was able to bring an understanding of the strengths and opportunities inside the business, communicate this in "bank speak", and remove a lot of anxiety.

- As a result, MCP could negotiate favourable lending terms and generate annual interest savings of several thousands of dollars.

- Most importantly, an ongoing mechanism supports the funding of new equipment.

Property Investor receives better terms with fewer covenants

Our Customer

The customer is an experienced investor, holding a diverse range of commercial and industrial properties. A separate trading business is owned by multiple family members.

Challenges

The customer was struggling to show the ability to raise finance for new and existing properties despite having a relatively low level of gearing, resulting in various separate lenders with different and time-consuming reporting covenants. Rates and fees were also expensive.

Strategy

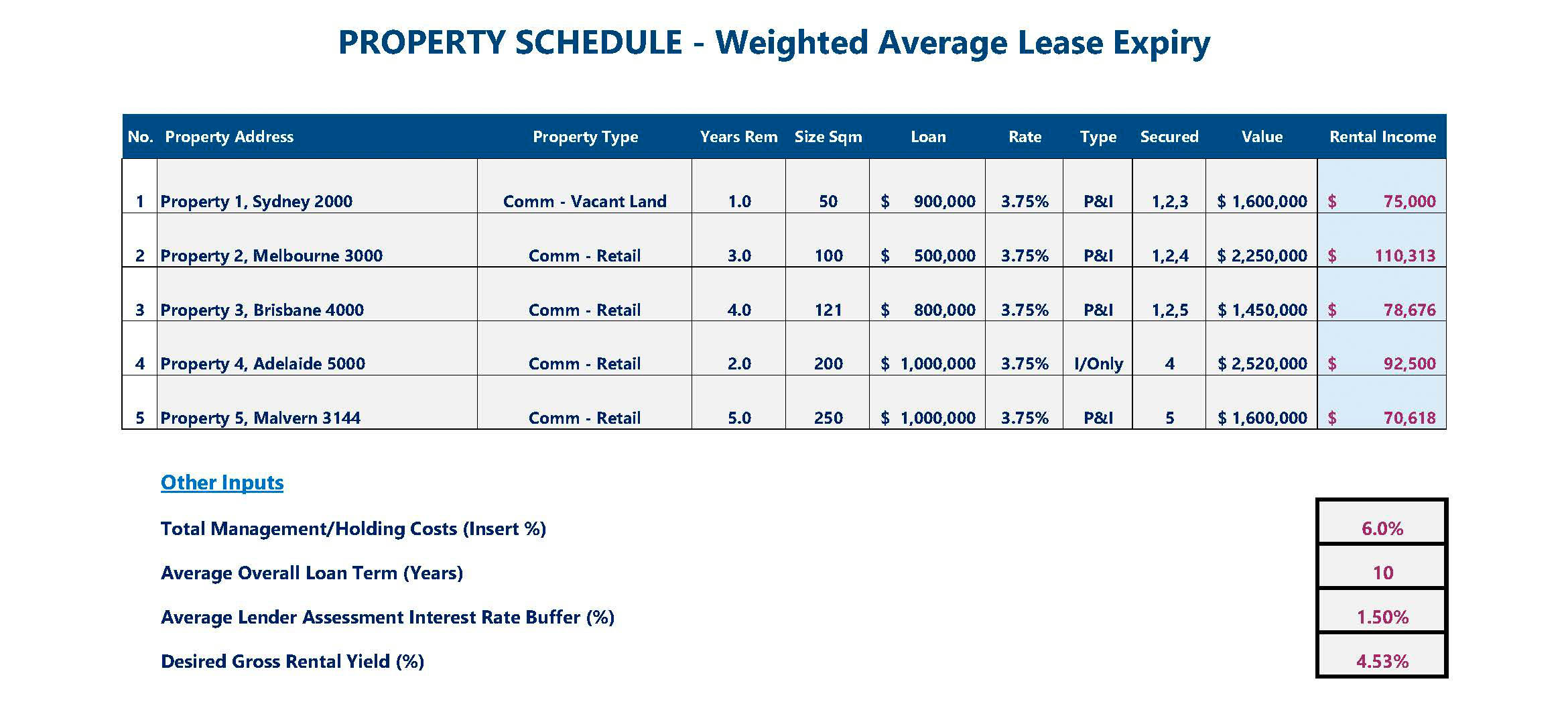

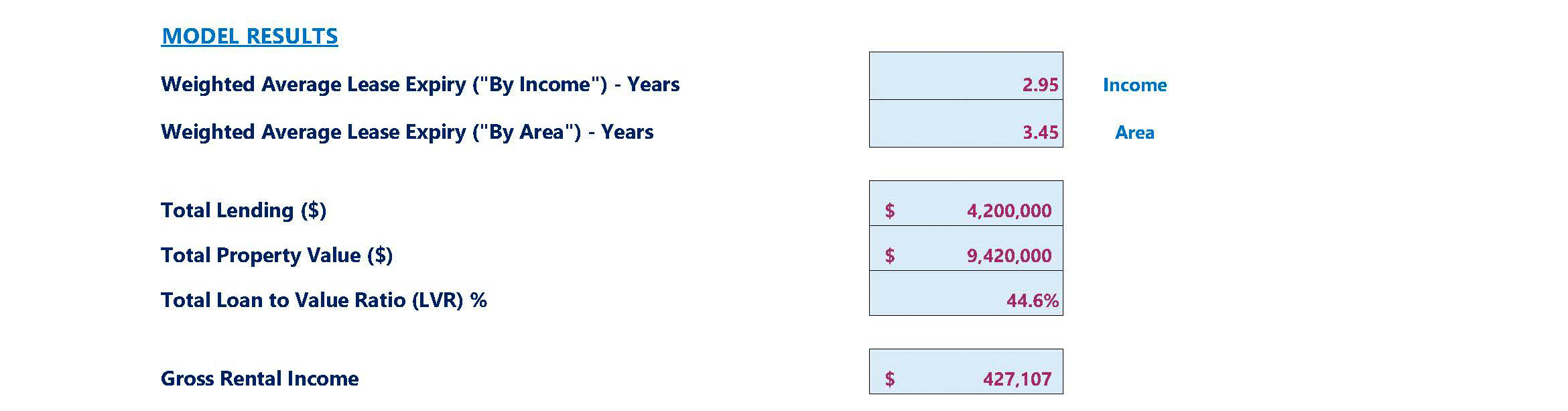

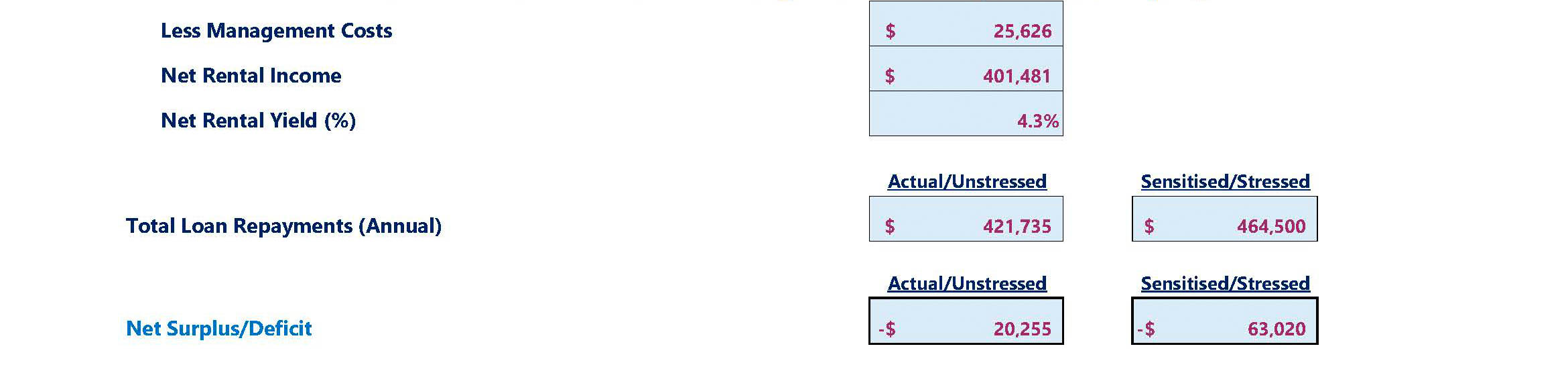

We helped our customer compile a property schedule that included an assessment of their "WALE" (Weighted Average Lease Expiry) by reviewing all existing property leases, gross income, and recent bank and independent valuation appraisals.

The initial findings were:

Results

Our review identified instances where incorrect data was communicated to credit providers. We demonstrated a more accurate overall financial position and drew attention to several mitigating credit factors.

From a credit perspective, the capacity to service debt was also strong and the interest rates charged were not reflective of that position.

Add Value

- MCP consolidated several lender relationships while negotiating more favourable lending terms and annual interest savings.

- An annual review process was established to enhance debt structure and plan for new property purchases in the future.